Warm upDavid Herpers is the Head of Product at Credit One Bank. His expertise includes wealth management, banking and product management.

- [responsivevoice voice = “US English Female” buttontext = “”]What industry do you work in and what is your role? [/responsivevoice]

- [responsivevoice voice = “US English Female” buttontext = “”]What are your responses in your role / position? [/responsivevoice]

- [responsivevoice voice = “US English Female” buttontext = “”]Can you describe to the function of your workplace / company? [/responsivevoice]

- [responsivevoice voice = “US English Female” buttontext = “”]How many departments, how many offices. National or International? [/responsivevoice]

- [responsivevoice voice = “US English Female” buttontext = “”]What are the minimum requirements for employment ie Education or Experience? [/responsivevoice]

- [responsivevoice voice = “US English Female” buttontext = “”]How many opportunities are there to ‘move up the ladder’? [/responsivevoice]

- [responsivevoice voice = “US English Female” buttontext = “”]What is the process for changing job roles ie Interview? Test? [/responsivevoice]

- [responsivevoice voice = “US English Female” buttontext = “”]Current projects? Deadlines? Opportunities? [/responsivevoice]

- [responsivevoice voice = “US English Female” buttontext = “”]Anything of interest happening? [/responsivevoice]

1.[responsivevoice voice = “US English Female” buttontext = “”]If you’ve looked at your savings account statement recently, you may have noticed a lower interest rate than you were expecting. Perhaps as low as 0.06%. This is not a typo.[/responsivevoice]

2.[responsivevoice voice = “US English Female” buttontext = “”]To put that into perspective, a rate of 0.06% is 6/100th of 1%. If you had $100,000 in your savings account, you would earn $60 per year in simple interest — so it would take a very long time to earn any meaningful amount of money. That’s not good if savings are a big part of your retirement plans.[/responsivevoice]

Why This Is Happening

3.[responsivevoice voice = “US English Female” buttontext = “”]To start, digital banks (loosely defined as a bank with few or no physical branches, lower overhead costs, and more of a digital approach to customer service) are making competitive strides against traditional banks, with some digital banks advertising savings account interest rates of 0.50% or more — with some rates nearly 10 times higher than what you might earn at a traditional bank. Right now, few other industries are experiencing price gaps like the ones between traditional and digital banks.[/responsivevoice]

5.[responsivevoice voice = “US English Female” buttontext = “”]If a bank’s loan portfolio is growing, the bank will need to grow deposits. If loans are growing faster than deposits, a bank can turn to the Federal Reserve to borrow the deficit.[/responsivevoice]

6.[responsivevoice voice = “US English Female” buttontext = “”]Banks are subject to regulatory rules that stipulate maximum leverage ratios, limiting their ability to borrow indefinitely. This means a bank can see an increase in expenses without the offsetting increase in revenue that a growing loan portfolio generates.[/responsivevoice]

[responsivevoice voice = “US English Female” buttontext = “”]Is a digital bank right for you? Have you ever considered buying shares in a company?What sort of business would you invest in?[/responsivevoice]

Why Digital Banks Offer Higher Interest Rates On Savings Accounts

7.[responsivevoice voice = “US English Female” buttontext = “”]Today, many large traditional banks have garnered respect from consumers as being stable and safe for storing their hard-earned cash. As a result, they have seen continued growth in deposits. Because of this, they don’t need higher deposit account interest rates to attract customers.[/responsivevoice]

8.[responsivevoice voice = “US English Female” buttontext = “”]Conversely, digital banks are seeing continued demand for their loan- or fee-based products. In many cases, this demand has outpaced their ability to attract deposits. These banks, unlike traditional banks, have a large appetite to grow deposits. They do so primarily by setting attractive savings account interest rates.[/responsivevoice]

[responsivevoice voice = “US English Female” buttontext = “”]Will traditional bank branches survive? What will be a reason to maintain them in future?

How many jobs in banking will become obsolete due to digital revolution?[/responsivevoice]

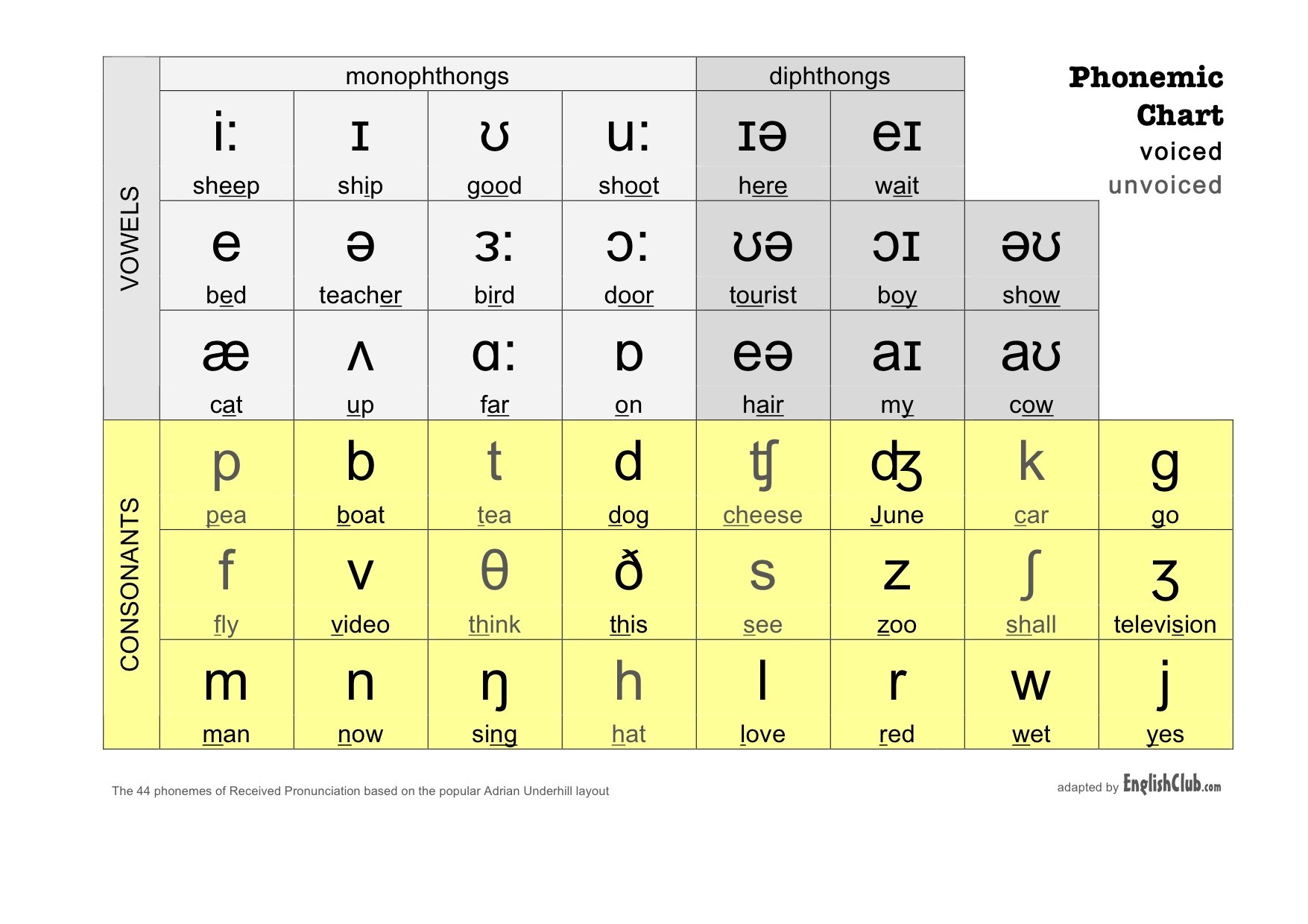

Phonetic Chart