1. President Joe Biden said Monday that people can rest assured the U.S. financial system is safe after the sudden collapse of two regional banks in the span of three days, emphasizing that his team took quick action to protect the interests of depositors and prevent the risks of wider financial fallout.

2. “Americans can have confidence that the banking system is safe. Your deposits will be there when you need them,” Biden said after U.S. regulators took control of California-based Silicon Valley Bank on Friday and New York-based Signature Bank two days later.

3. The failure of Silicon Valley Bank, which has $209 billion in assets and is a major lender for startups, was the second-largest bank collapse in U.S. history, behind only the 2008 failure of Washington Mutual during the global financial crisis. Amid contagion fears, U.S. financial authorities took extraordinary steps on Sunday, guaranteeing customers of the two banks access to all their money and setting up a new facility to enable banks to secure emergency funds.

How has this news been reported in Japan? Do you expect a major economic crisis to take place in the near future?

4. Speaking at the White House in the morning before the opening of U.S. financial markets, Biden said, “This is an important point. No losses will be borne by the taxpayers. Let me repeat that. No losses will be borne by the taxpayers.” The president said “we must reduce the risk of this happening again,” adding that his administration will ask Congress to strengthen the country’s banking regulations.

5. He also cited the relaxation of some banking requirements under his predecessor Donald Trump, placing blame for the current failures on the previous administration’s actions. With a divided Congress, however, the possibility of a bipartisan agreement to implement stricter rules remains uncertain.

6. While the abrupt failures have left investors in the United States and elsewhere jittery, Biden said his administration “will not stop at this. We will do whatever is needed on top of all this.” He said the managers of the two banks will be fired, as both institutions have been taken over by the Federal Deposit Insurance Corporation. Signature, which had about $110 billion worth of assets as of December, became the country’s third-largest bank ever to collapse.

・Are you generally satisfied with your government’s economic policies?

・What industries would you say are most important to your country’s economy?

7. The demise of Silicon Valley Bank is attributable to rapid increases in interest rates by the U.S. Federal Reserve, which has been trying to tame high inflation. The Fed’s cycle of rate hikes undercut the value of the bank’s holding of bonds. Also, higher borrowing costs were detrimental for startups in the technology industry, the bank’s primary focus.

8. With the collapse of the two banks, some economists and market analysts have started predicting that the Fed will be forced to stop raising interest rates next week. Until recently, a number of experts were anticipating the U.S. central bank to lift its key interest rate by 0.5 percentage point in its next policy meeting on March 21 and 22, especially after Chair Jerome Powell’s remarks early last week.

9. “The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated,” Powell said in a hearing of the Senate’s banking committee last Tuesday.

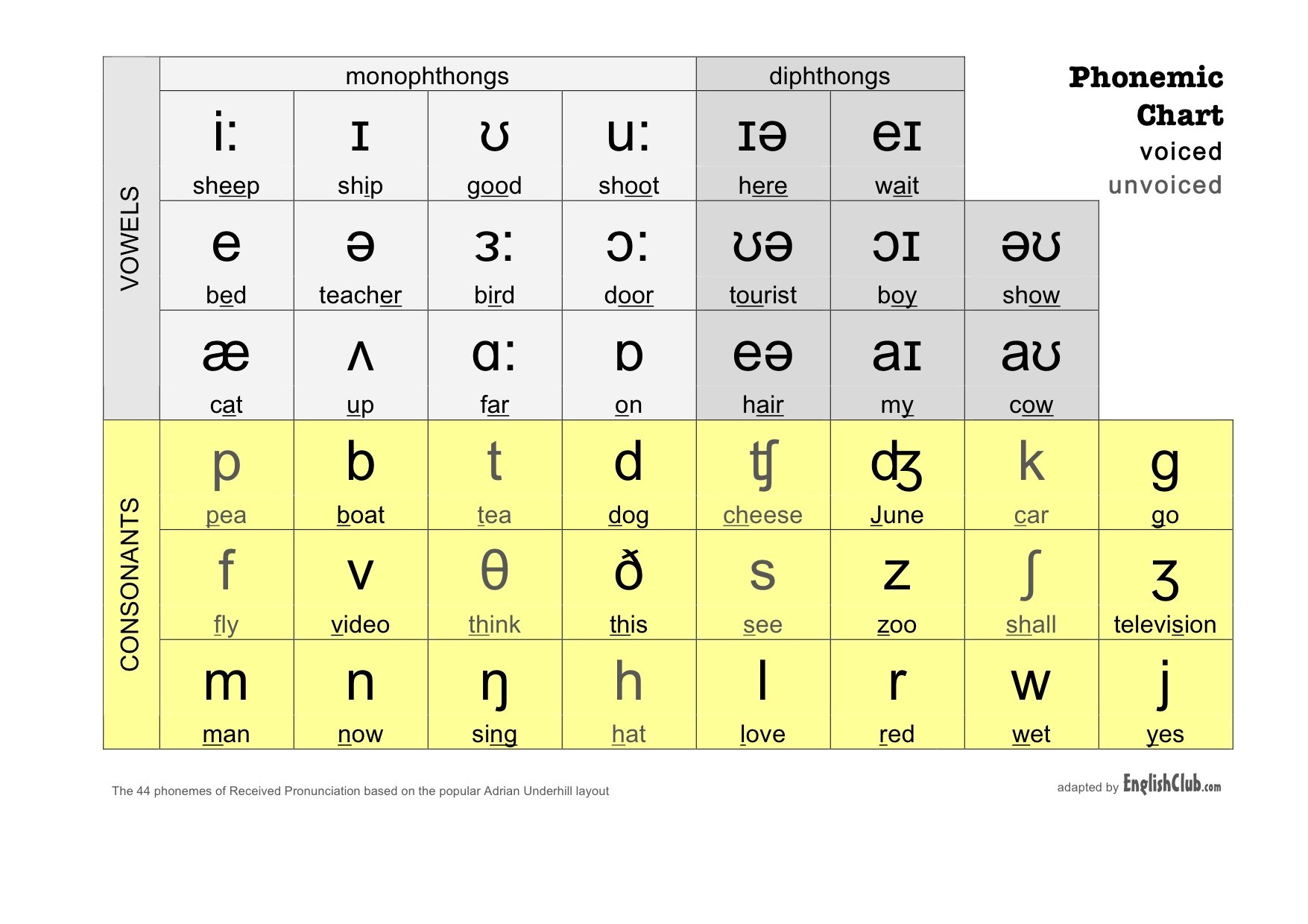

Phonetic Chart