1. It took fewer than eight days for Sam Bankman-Fried to go from being nicknamed the “King Of Crypto” to his company filing for bankruptcy and him stepping down as chief executive, facing federal investigations into how he handled the company’s finances.

2. Over the last few years, the internet has been flooded with long interviews with him, speaking over video chat from his office desk in the Bahamas. In some of them, there’s a distracting clicking noise. As his interviewees listen intently to his incredible story of how he became a multibillionaire in five years, the sound is persistent and clearly coming from the American entrepreneur’s mouse. “Click, click, click,” it goes, in rapid, on-off bursts. Meanwhile, Mr Bankman-Fried’s eyes dart around the screen.

3. It’s not clear from the videos what he’s doing on his computer, but his tweets can give us a pretty good clue. “I’m (in)famous for playing League of Legends while on phone calls,” he tweeted in February 2021. Mr Bankman-Fried – the former boss of embattled cryptocurrency exchange FTX – is an avid gamer. And in a series of tweets to his nearly one million followers, he explained why. Playing the team fantasy battle game was his way to get his mind to switch off from running two companies trading billions of dollars a day. “Some people drink too much; some gamble. I play League,” he said.

How do you think this will affect the broader industries associated with cryptocurrency?

4. Since the 30-year-old’s cryptocurrency empire collapsed this week in dramatic fashion, another anecdote about his gaming has resurfaced online. According to a blog post from venture capital giant Sequoia Capital, Mr Bankman-Fried played an intense League of Legends battle during a high-level video call with their investment team. It didn’t seem to put off them at all, though. The group proceeded to invest $210m in Mr Bankman-Fried’s company FTX.

5. This week, Sequoia Capital deleted that gushing blog post and announced it is now writing off their FTX investment as a loss.The firm is not the only investor to have lost eye-watering amounts of money since Mr Bankman-Fried’s $32bn empire collapsed. FTX had an estimated 1.2 million registered users who were using the exchange to buy cryptocurrency tokens such as Bitcoin and thousands of others.From large traders to everyday crypto fans, many are left wondering if they will ever get back their savings trapped in FTX’s digital wallets.

6. It’s a dizzying downfall and the rise of Mr Bankman-Fried is also its own dramatic story of risks, rewards and beanbags. Mr Bankman-Fried went to Massachusetts Institute of Technology (MIT) – a prestigious US research university where he studied physics and maths. But the young bright undergraduate says it was lessons learned in the student dorms that led him on his path to getting rich.

Since that last time we had an article about cryptocurrency, has attention or news about it increased? In your eyes, has its image changed? How so?

7. In a BBC radio interview last month, he recalled being swept up in the “effective altruism” movement. Effective altruism is a community of people “trying to figure out what practical things you can do with your life to have as much positive impact as you can on the world”, he said. So, as Mr Bankman-Fried recalls, he decided to get into banking to make as much money as he could to give it back to good causes.

8. He learned to trade stocks during a short stint at trading firm Jane Street in New York before he got bored and decided to experiment with Bitcoin. He noticed the variations in the value of Bitcoin across different cryptocurrency exchanges and started arbitraging – buying Bitcoin from places selling it cheap and selling to other places where it was trading for more.

9. After a month of making modest profits, he got together with some college friends and started a trading business called Alameda Research. Mr Bankman-Fried says it wasn’t easy and took months of perfecting techniques about how to move money in and out of banks and across borders. But after around three months, he and his small team hit the jackpot. “We were super-dogged,” he said to the Jax Jones and Martin Warner Show podcast a year ago.

https://www.bbc.com/news/technology-63612489

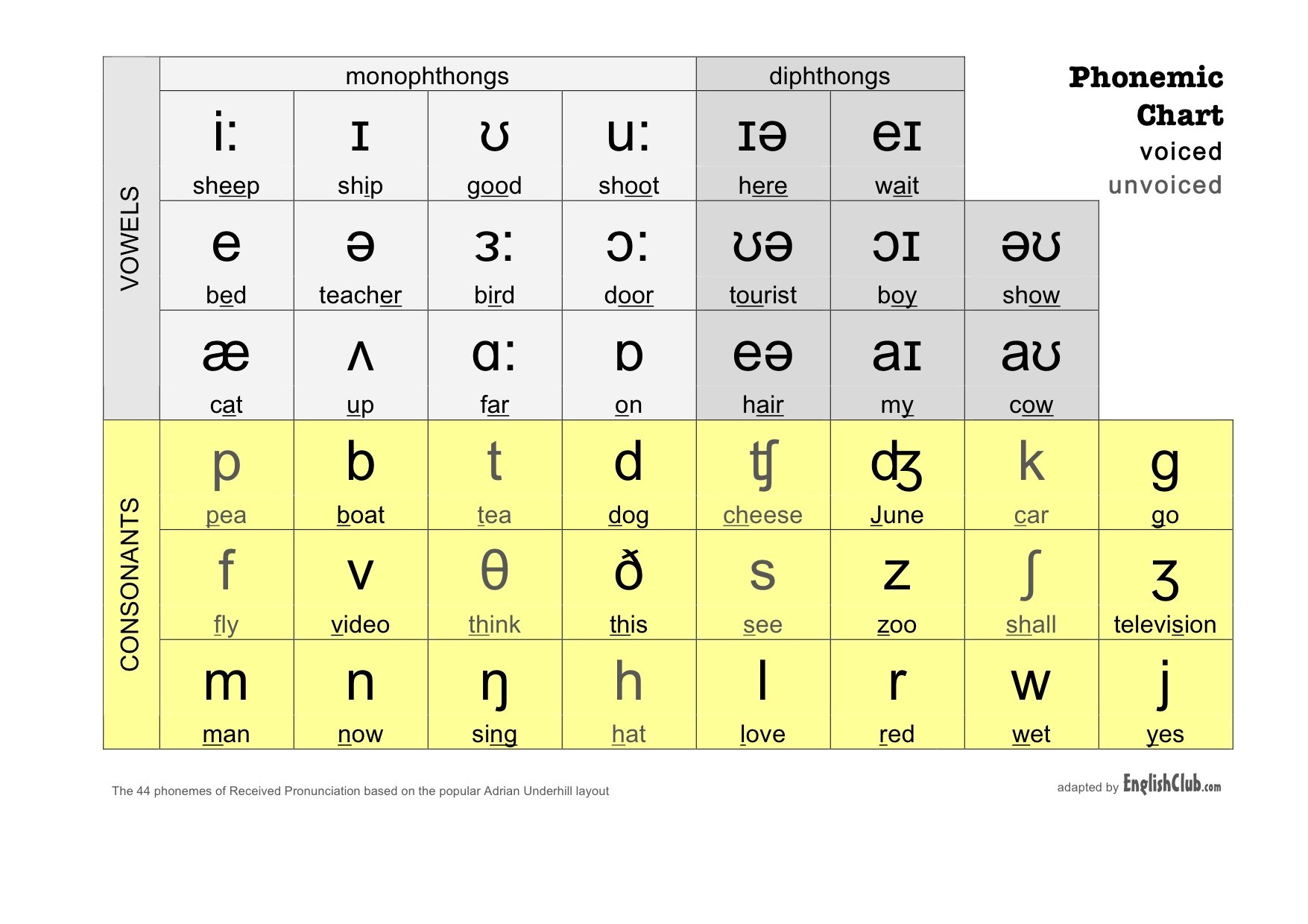

Phonetic Chart