Warm up

—- * * FOR NEW STUDENTS ** ————————————— ————

- What industry do you work in and what is your role?

- What are your responses in your role / position?

- Can you describe to the function of your workplace / company?

- How many departments, how many offices. National or International?

- What are the minimum requirements for employment ie Education or Experience?

- How many opportunities are there to ‘move up the ladder’?

- What is the process for changing job roles ie Interview? Test?

————————————————– —— ——————————————– ——- —

General discussion about your workweek:

- Current projects? Deadlines? Opportunities?

- Anything of interest happening?

————————————————– —— ——————————————– ——–

Script

1. Disney reaffirmed that the Direct-to-Consumer division will be a corporate priority over theatrical. This is reinforced with an updated, impressive total of 137 million subscribers as of December 2, 2020 across all platforms and a projected 300-350 million subscribers by 2024.The Direct-to-Consumer division already hit $16.9 billion in revenue in Disney’s year end 2020 financial report, thus eclipsing the studio’s 2019 pre-COVID revenue of $11.1 billion. There is no going back.

2. Disney’s distribution strategy is on target and expanding rapidly. The earlier alliance with platforms like Roku and Amazon Fire helped Disney+ become available for most U.S. Households. They are now expanding distribution into the Indian market where a growing middle class has significant disposable income. It is also making a sizable thrust into the Latin market and creating a distribution deal with a Disney+ inclusion in Fortnite.

3. Disney intends to ratchet up premium content. The company revealed over 100 new pieces of content that are designed to offer “highly curated…juicy” shows and films using proven showrunners, filmmakers and “A” list talent Disney now projects that by 2024 it will spend between $14-16 billion in content including 10 new Marvel series, 10 new Star Wars series, and 15 new Disney originals. Stories in selected TV series will be connected to stories in film releases, enticing audiences to experience both in order to achieve the full narrative.

4. Now that Disney has proven its worth, it is increasing the price. Its new price is still well below competitive offerings, and so added price hikes can be expected in the future

5. Disney is pursing both subscriber growth and ad revenue. This is relevant for Ad-supported platforms Hulu and ESPN+. This will help ease the pain as Ad-supported content in legacy networks eventually declines.

6. Disney is expanding its synergy across platforms: Just as Disney provided a bundle of Disney+, ESPN and Hulu, ABC News will be accessible via Hulu. This will cross promote interest and viewership. It is one peek at the underlining synergistic opportunities.

7. Disney now has a basic film launch plan: 80% of the new content will launch via Direct-to-Consumer. For film considerations, there appears to be 4 basic launch options at the company’s disposal: Theatrical 1st: This movie launches theatrically first and afterwards it will be provided free on a company-owned streaming service for subscribers, Simultaneous, Direct to Streaming for Free: This movie bypasses theaters and launches directly on a company-owned streaming service at no extra charge. Direct to Streaming for a Premiere Access Fee: This movie bypasses theaters and is available for a Premium Access fee on a company-owned streaming service

The 10 Major Industry Implications for 2021 and beyond

Though Disney did not detail the implications of its decisions for the broader industry, they are plentiful given the company’s size and scope.

1. Linear, legacy units like ABC, NBC and CBS will lose resources to streaming divisions. Money, talent, staff, employment opportunities, and production will flow toward streaming. Legacy units may be starved for resources.

2. The rise of streaming will result in an accelerated decline of network viewers and cable subscribers, leading to a corresponding fall in TV ratings.

3.Giant entertainment companies will continue to spend heavily on premium content. This will raise the demand and price of prominent showrunners and filmmakers, which in turn will raise the price of production. Interconnected narratives that cross film and television storytelling will also increase expense. Streaming divisions within traditional studios will continue to lose money in the short-term but will look for subscriber growth to achieve breakeven. The desire to increase subscriber fees will be great – as Disney indicated with its price increases.

4. Entertainment companies will continue to horde their unique content in order to justify subscription fees. Smaller studios may get gobbled up (e.g. Lionsgate) to feed another studio’s library. Studio analytics will switch from maximizing box office and downstream revenues (e.g. dvd, licensing) to maximizing the lifetime value of a subscriber. Studios without a competitive streaming service (e.g. Sony Pictures) will have a unique niche by licensing their content to all others.

5. Studios will have an unprecedented method to target unique audiences with unique content, messages, and other offerings. As more audiences adopt streaming, it allows traditional studios to understand specific preferences of individuals and to offer highly specific content and messages, something Netflix and Amazon Prime already do. Importantly, it can allow traditional studios to optimize synergy by selling tailored merchandise, theme park experiences, and other divisional offerings. This may accelerate the decline in big box retail stores. At the same time, consumer privacy concerns are apt to be voiced by consumer groups and governmental policymakers that are uncomfortable with the amount of personal data companies will capture.

6. The streaming effort to penetrate foreign markets will dominate. This is because penetration in foreign markets is lower than in the saturated U.S. market. Content created for specific countries will be given a priority, and demand for local stories, talent and production will rise…increasing production costs along with it. At the same time, U.S. consumers have become more accustom to foreign films with subtitles, most notably with the success of the South Korean film Parasite and the 2017 Spanish television series Money Heist. This may result in more foreign films coming to the domestic market.

7. Audience shifting behavior will continue to reshape the entertainment marketplace. This was already apparent in their rejection of cable, embrace of streaming, and the use of multiple devices. Due to COVID, many who have successfully worked from home may desire to continue to do so even after the coronavirus is gone. If so, entertainment viewing may become more of an “anytime” affair as employees mix work and entertainment rather than using the more traditional schedule in which work is 9-to-5 and entertainment begins afterwards.

8. Theater chains are apt to fail with AMC leading the way. They are collateral damage as studios create a new model to optimize streaming revenue. As one or more theater chains enter bankruptcy, studios might prop them up with an investment to protect their theatrical window, while Netflix or Amazon might invest to gain an added distribution path. If one jumps in, others may follow. Theater chains that remain will contract in influence and size, and the number of locations will likely fall. If theaters exit malls it will put added strain on mall operators and their remaining tenants, showing the ripple effect of the decline.

9. The Academy of Motion Picture Arts and Sciences may, begrudgingly, consider changing its policy and accept films for Oscar nomination that were never shown in theaters. It approved this for 2021 award season due to COVID-19 but only for films that had a previously planned a 2020 theatrical release. But with the explosion of quality films on the streaming platform, it will be harder and harder for the Academy not to bend, especially since prominent filmmakers have now rushed toward the streaming marketplace (e.g. Martin Scorsese’s The Irishman for Netflix)

10.In a tangent to Disney’s efforts, shows that blend content and interactivity will grow. Videogames have a long history of blending cinematic scenes with gaming to enhance the overall experience. Studios are likely to experiment with blending, most notably by Netflix’s successful film, Bandersnatch. Showrunners who have experience with both mediums will be in demand.

Disney’s Investor Day reveal rock-solid strategies. The implications for the broader industry are even more profound.

Discussion

1. Do you think theaters will ever be as popular as they once were? How do you feel about the changing landscape of cinema?

2. Would you prefer to pay a premium and have no advertisements, or watch for free with regular intervals of advertising?

3.

Who are Disneys greatest competitors in “on-demand entertainment”. What do you think the market will look like in 10 years?

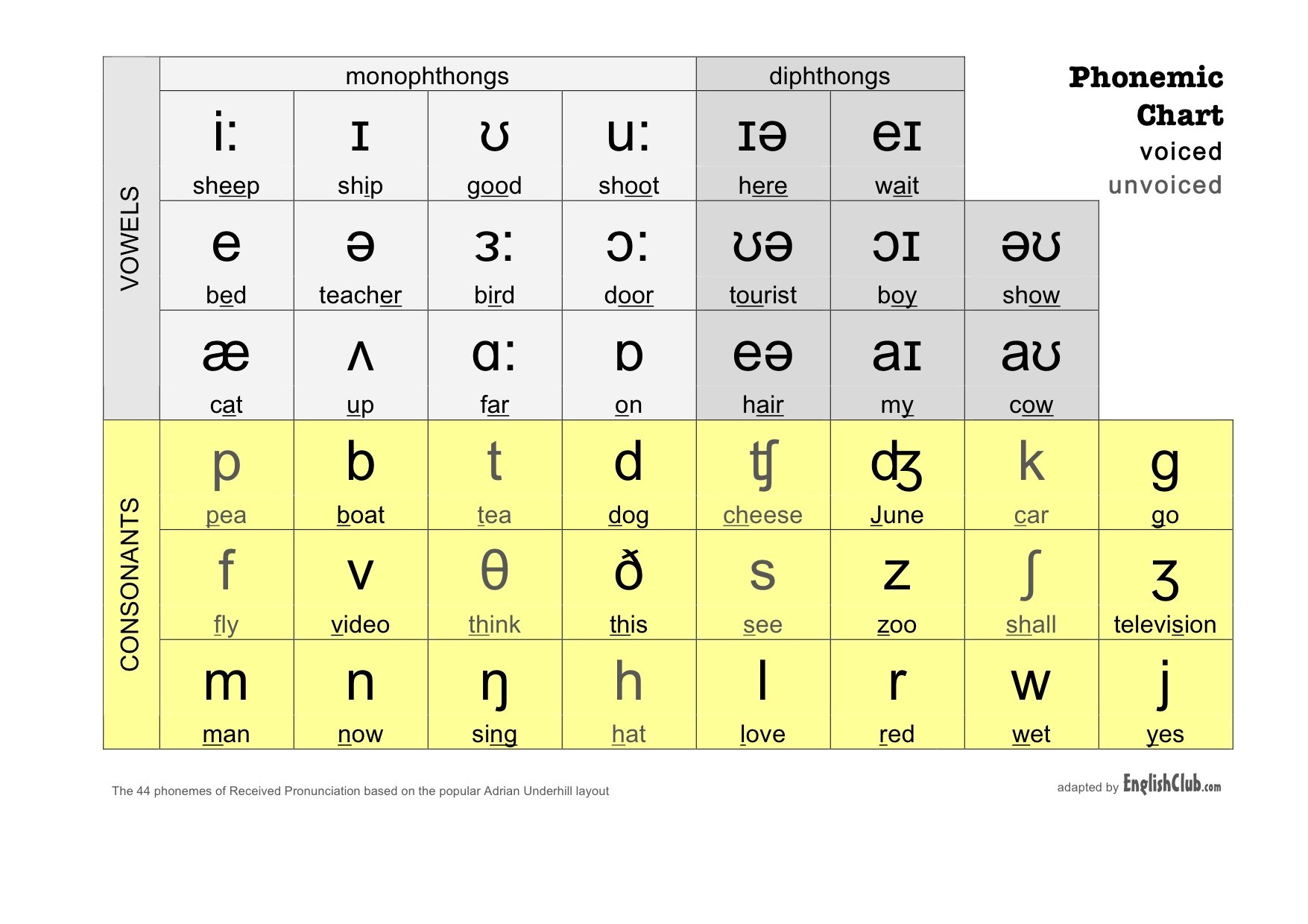

Phonetic Chart