Warm up

—- * * FOR NEW STUDENTS ** ————————————— ————

- What industry do you work in and what is your role?

- What are your responses in your role / position?

- Can you describe to the function of your workplace / company?

- How many departments, how many offices. National or International?

- What are the minimum requirements for employment ie Education or Experience?

- How many opportunities are there to ‘move up the ladder’?

- What is the process for changing job roles ie Interview? Test?

————————————————– —— ——————————————– ——- —

General discussion about your workweek:

- Current projects? Deadlines? Opportunities?

- Anything of interest happening?

————————————————– —— ——————————————– ——–

Script

1. “Game-changing” is how Kohl’s CEO Michelle Gass characterized the partnership with Sephora it announced today, and the impact it will have on the retailer’s beauty business. “It’s a massive deal,” Gass said in an interview. “We’ve been looking at the beauty opportunity for a long time. We’ve put a greater emphasis on beauty. We were doing [nicely.] We wanted to make much bigger, bolder progress.”

2. Sephora at Kohl’s, the 2,500-square-foot beauty destinations, are designed to look like Sephora’s own stores. At Kohl’s units with two doors – about 80% of the fleet – Sephora will have a dedicated entrance, its logo on the facade. “That’s how much we believe in this partnership,” said Gass. The shops will be prominently located at the front of stores, with the first 200 Sephora at Kohl’s shops-in-shop bowing in fall 2021. Kohls.com’s online beauty selection will exclusively showcase an expanded Sephora assortment. The concept by 2023 will expand to at least 850 stores, Kohl’s said.

3. Sephora at Kohl’s will provide immersive and elevated experiences combining Kohl’s customer reach and omnichannel convenience with Sephora’s prestige service and selection of premium products. “Beauty is expected to grow over the next five years,” Gass said. “We’re significantly under-represented. We’ll tap into that.” While beauty is only a modest low single-digit penetration of the business, Kohl’s has driven steady growth of nearly 40% over the past five years, Gass said during the retailer’s third-quarter earnings call last week. Gass also made the bullish pronouncement that Kohl’s has its sights on tripling sales and driving incremental traffic.

4. “As you would imagine, with a deal of this magnitude, we’ve been in conversations for a long time, many months,” Gass said. Gass said Sephora at Kohl’s aims to make aspirational beauty products accessible to more consumers. “This is an extraordinary time of change,” said Gass. “I’m thrilled to partner with Sephora, a brand that shares our values and passion for innovation and reinvention. This is a perfect illustration of the bold moves Kohl’s is making to accelerate our growth and reimagine our future for the next era of retail.”

5. The new deal will allow both retailers to grow their respective customer bases. Sephora, which operates 500 stores in the Americas, will gain access to most of Kohl’s 65 million consumers who shop its 1,150-plus locations, with limited overlap between the two retail networks. Gass said, “We’re absolutely expecting younger customers.”

6. Kohl’s has been on a mission to attract younger consumers for several years, launching new brands such as LC Lauren Conrad, PopSugar, and creating the Pinterest-inspired, trend-oriented Outfit Bar. The retailer has also shown its propensity for innovation and taste for risk. Case in point, Kohl’s deal with Amazon AMZN +0.5% to accept returns on behalf of the digital behemoth.

7. “This is not a pop-up collaboration, but an investment our brand partners can rely on for the long-term,” said Jean-André Rougeot, president and CEO of Sephora Americas. “As a company with a history of sustained, decades-long partnerships, Sephora has every confidence in the future of this collaboration and the unique experiences it will bring to consumers across the U.S.”

8. Kohl’s news follows last week’s Target’s announcement of its own lofty beauty goals, which include hooking up with Ulta Beauty ULTA -2.5% to create shops-in-shop launching in 2021 in more than 100 stores, with plans to scale to hundreds more over time. There will also be an online Ulta Beauty component at Target.com TGT -0.4%. Department store cosmetic counters were once cash cows, driving traffic to stores and building loyalty among consumers, and were considered so sacred, beauty products were rarely put on sale.

9. The decline of beauty sales at department stores opened the door to mass retailers, which have proven to be more nimble than their pricer cousins. Beauty product sales in department stores in the third quarter declined 17% year-over- year to $3.7 billion. “The prestige beauty market is increasingly being shaped by channel shifts and a whole host of indie brands,” said the NPD Group.

10. Sephora for years has been nipping at the heels of department store beauty counters such as Macy’s M -5.3%, with its mix of prestige and indie brands, and knowledgable sales assistants, some of whom are also makeup artists. The open-sell format allows customers to try-on and experiment with the products, however, that’s on hold due to the coronavirus pandemic.

Discussion

1. What are beauty product shops do you know?

2. Do you think they will be affected by the covid 19?

3.

Do you think that the era of going out shopping is over?

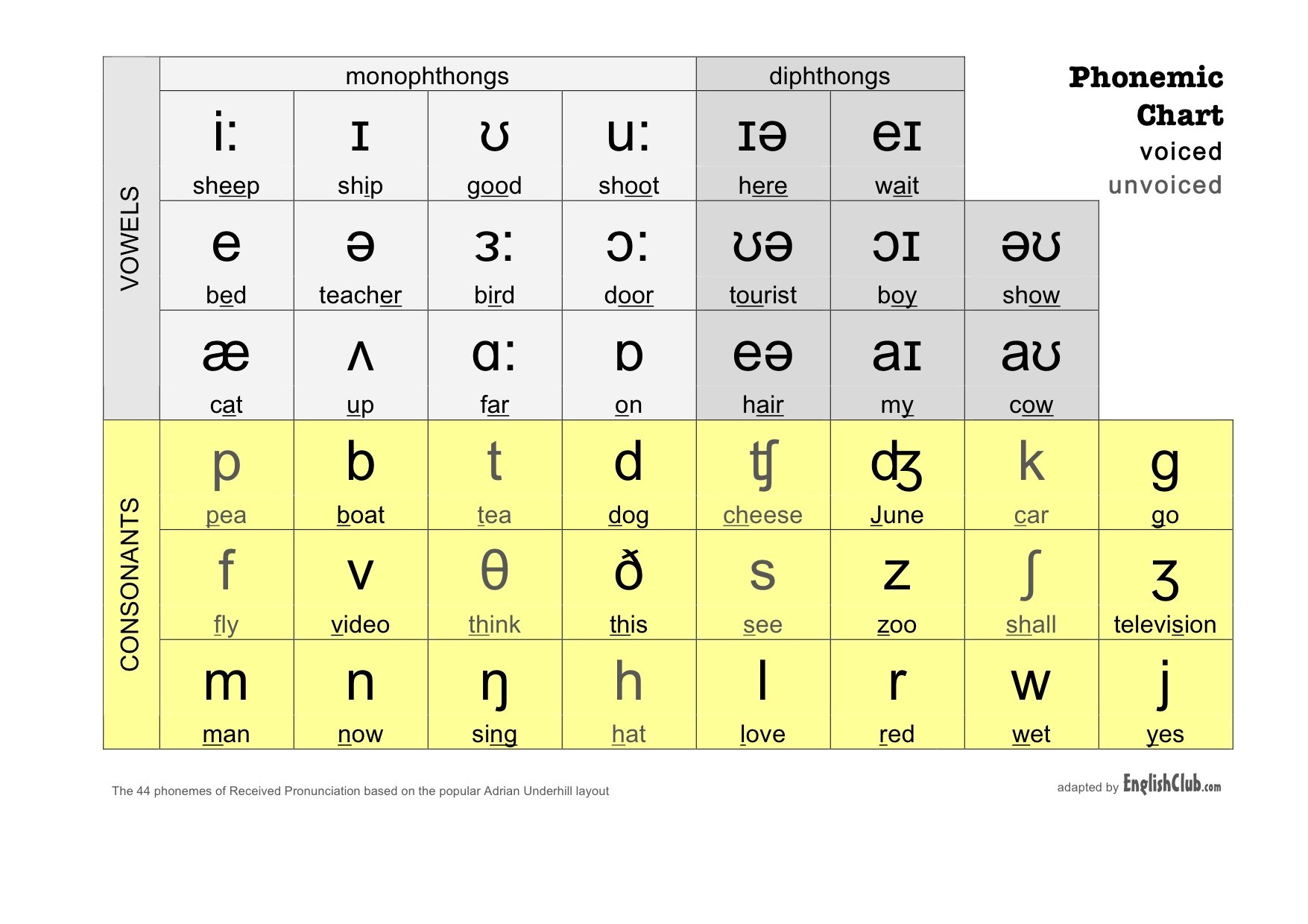

Phonetic Chart