Warm up

—- * * FOR NEW STUDENTS ** ————————————— ————

- What industry do you work in and what is your role?

- What are your responses in your role / position?

- Can you describe to the function of your workplace / company?

- How many departments, how many offices. National or International?

- What are the minimum requirements for employment ie Education or Experience?

- How many opportunities are there to ‘move up the ladder’?

- What is the process for changing job roles ie Interview? Test?

————————————————– —— ——————————————– ——- —

General discussion about your workweek:

- Current projects? Deadlines? Opportunities?

- Anything of interest happening?

————————————————– —— ——————————————– ——–

Script

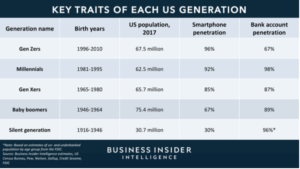

1. INTRODUCTION Gen Z, comprised of those currently 9 to 23-years-old, is now the largest generation worldwide: The cohort accounts for 32% of the current global population — expected to tick up to 40% by 2020 — and includes nearly 68 million people in the US alone.

2. But the oldest Gen Zers are now in their 20s, and in the US, they represent an estimated 26% of consumers — a term that’s largely synonymous with adults. As Gen Zers age and their financial services needs broaden, making them more relevant to banking and payments players, it’s becoming increasingly pressing for providers to shift focus to the burgeoning demographic

3. Appealing to Gen Z requires banks and payments firms to cater to the attributes that set these consumers apart from older generations. Gen Zers aren’t identical to their older counterparts: In addition to having low financial services adoption, they’re more receptive to influence from family and peers than traditional advertising and don’t remember life before the internet. For marketers, strategists, and developers, understanding Gen Z’s unique needs — and creating and marketing products accordingly — will be critical to reaping their value.

4. Business Insider Intelligence has developed a six-point framework that highlights Gen Z’s core traits, which banks and payments firms can use to attract, engage, and retain Gen Zers. We’ve found that in order to appeal to Gen Z, financial services products must be social, authentic, digital-native, and educational, offer value, and evolve over time. Our framework was developed based on industry research and conversations, and can serve as a guide for firms looking to develop relationships with this generation.

5. Social. Gen Z’s largest influencers are their friends and family: 19% and 17% of Gen Zers cited these groups, respectively, as how they discovered a product — the top two cited tools for brand discovery among this generation, according to OCC Strategy. This predisposition to friends and family marks a distinction from previous generations, who are more inclined to discover brands while out shopping or through traditional advertising methods: 24% of baby boomers, for example, discover brands while out shopping, while only 8% of Gen Zers do the same.

6. Hence, what truly sets Gen Z apart is that they’re most impacted by other people, especially those that they care about. For financial services firms, searching for touchpoints that emphasize interaction, like peer-to-peer (P2P) payments or other shared financial experiences, and enmeshing services into Gen Z’s existing social channels could help effectively capture this generation.

7. Engaging Gen Z Gen Zers want usable products that give them a tangible benefit — but they also have the shortest attention span yet, clocking in at only 8 seconds before they abandon an experience. To engage this generation, providers need to cater to these needs and offer products that are digitalnative as well as educational, offering fast access that feels familiar to Gen Zers and bringing value by allowing them to learn from the service.

8. Digital-native. Gen Zers live and die by their smartphones, which most members receive before age 10: 46% of Gen Zers can’t go more than an hour without checking their phones, with most users spending up to 9 hours a day on their phones, and 59% use technology for as many tasks as possible, according to Snapchat and Synchrony Financial. And Gen Z’s exceptionally digital nature influences their product choices: 60% of Gen Zers won’t use an app or website that’s too slow, for example.

9. For users who are particularly attuned to paying and banking online — Gen Z is “twice as likely” as older generations to shop online, and 70% of eligible customers use banking apps daily, per Bluefin — providers need to emphasize user experience (UX) through simple interfaces and clean navigability to ensure these customers come back and form habits, rather than leave for another provider.

10. Educational. Gen Zers love learning: An inability to remember the world before the internet has made them “adept researchers,” with Gen Zers using an average of 2.4 sources — the second highest of any generation — to research brands or products before making decisions. Their desire to research and learn could carry over to financial services, where Gen Zers are still learning financial habits. Many Gen Zers are earning money: Around three-quarters earn their own spending money through chores, employment, or freelancing. Further, these young consumers are very interested in saving after growing up during the Great Recession, and they tend to be frugal, which opens an opportunity for providers to teach users how best to manage their money and approach their finances — a strategy that can keep these users coming back.

Discussion

1. Which brands do you think are most actively targeting this demographic? In what way are they advertising?

2. Who are the most influential people for this generation?

3. What products do you think are most attractive to people in this generation, do you know anyone / have any family members approximating this age? What are they most interested in buying?

4.

What are the greatest differences between your generation and gen Z (in relation to spending habits and interests) why?

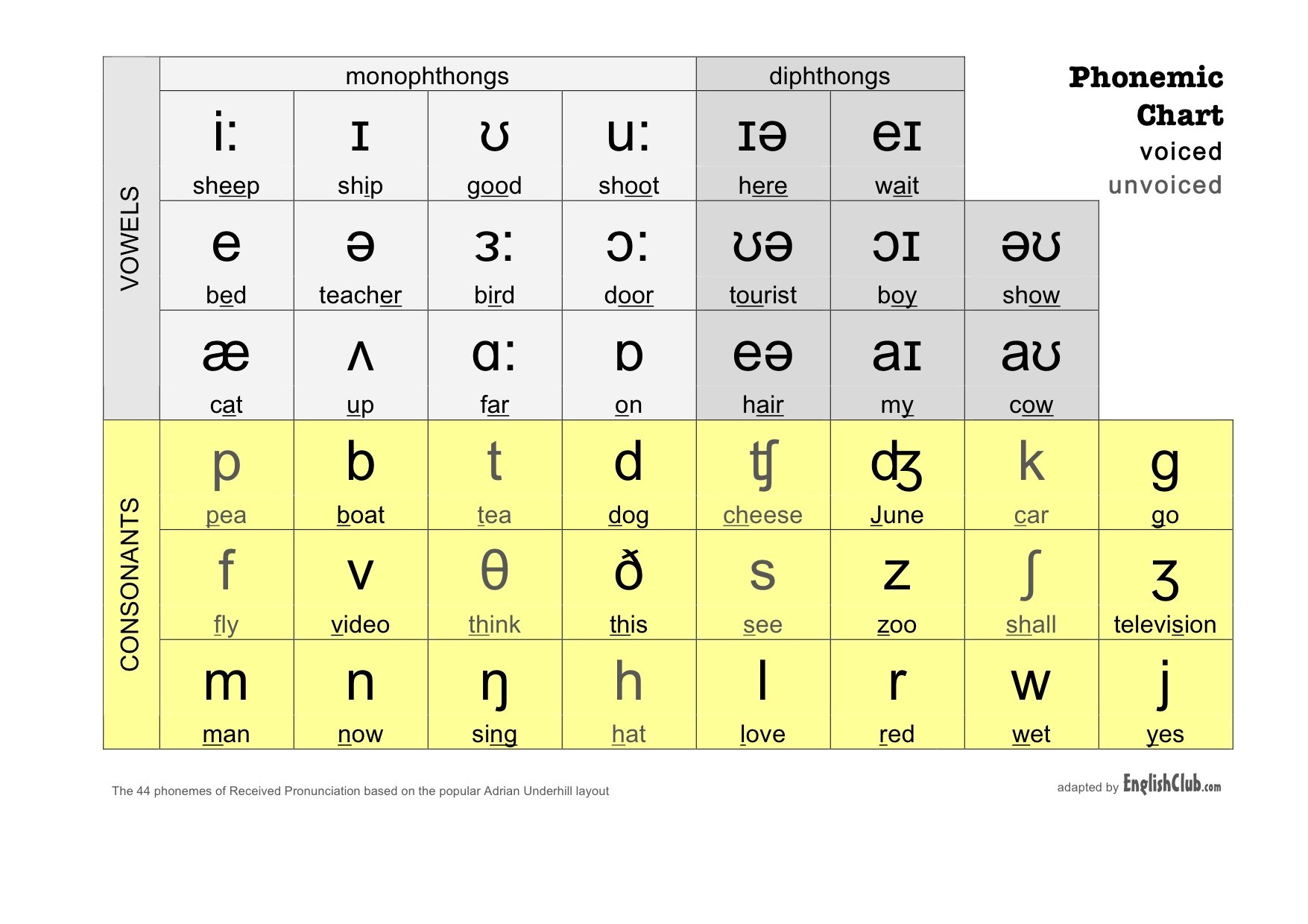

Phonetic Chart